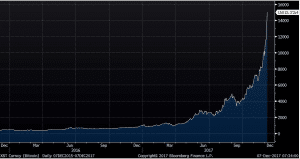

Is Bitcoin a Digital Currency or a Digital Tulip Bulb mania? Many investors are wondering if electronic money deserve a place in their portfolios.

WHAT IS BITCOIN?

Simply put,

- Bitcoin is a digital currency also called a “cryptocurrency.”

- It is a form of code made by computers and stored in a digital wallet.

- Transactions are recorded on a public ledger called blockchain.

- Decentralized — there’s no government, bank or other authority that controls it.

- Finite supply: 21 million units (16 million in circulation).

- 1,000: More than a thousand digital currencies, with more sprouting up every day.

HOW DO YOU GET A BITCOIN?

- Digital currency exchanges like Coinbase — where you can buy, sell and store Bitcoins.

- Getting started is about as complicated as setting up a Paypal account.

- You can use Bitcoin to buy things from more than 100,000 merchants.

- You can sell it. Or you can just hang on to it.

- Recent price, ~$17,000 per bitcoin.

WHAT PLACE IF ANY SHOULD BITCOIN PLAY IN A DIVERSIFIED PORTFOLIO?

- Skip it for now.

- 2017 Bitcoin price range: $1000 to $19000!

- Bubble Mania? Reminiscent of tulip mania that hit Holland in the 1600s, tech stocks in the 1990s, real estate in the 2000s.

- Bitcoin has no fundamentals. No revenue or cash flows, no interest yield, and no physical assets backing it up.

- Warren Buffett quote: “FOMO” (fear of missing out). Supply and demand forces at work at present.

- High-risk products with an unproven track record and high price volatility.

- High risk of fraud: Multi-million dollar digital thefts have already occurred!

Click image to enlarge