The U.S. stock market recently entered correction territory – dropping about 10% – for the first time in two years. The increased market volatility continues to rattle investors. What is causing the market decline and what should you do about it? Here are 8 tips for your investment strategy.

WHAT IS CAUSING RECENT MARKET VOLATILITY?

- Investor Sentiment: over-reaction leads to more selling and downward pressure.

- Inflammatory headlines: for example, “crash, panic, cratered, largest point decline in history”

- Increasing inflation pressure.

- Rising interest rates.

THE STOCK MARKET HAS BEEN LOOKING A LITTLE PRICEY, IS THERE SUCH A THING AS A “HEALTHY CORRECTION?”

Absolutely!

- High stock valuations adjust to more reasonable levels.

- Over-eager investor sentiment gets a reality check.

DOES THE DOWNTURN CONCERN YOU?

Not particularly:

- Economic and Corporate growth remain strong.

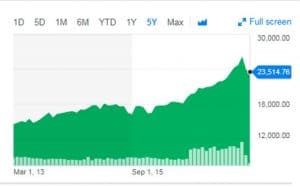

- Declines are common. 10% corrections have occurred in two-thirds of years since 1979.

- Pullbacks are likely to be temporary. Just look at history.

WHAT TIPS DO YOU HAVE FOR INVESTORS?

- Have a game plan.

- Stay globally diversified

- Know what you own and why you own it.

- Be patient.

- Rebalance back to target allocations.

- Stay the course unless your financial situation has changed.

- Play defense: Do you need to increase defensive assets such as cash or short-term bonds?

- Continue to save. Remember the time-tested wisdom of “buy (rebalance) low, sell (rebalance) high.”

(Click image to enlarge)