When your local weather forecaster tells you that it’s going to rain, what do you do? That’s easy–you reach for your umbrella. So why not purchase an umbrella that can protect you in stormy financial weather? Umbrella liability insurance (ULI) can do just that. By providing liability protection above and beyond the basic coverage that homeowners/renters and auto insurance policies offer, ULI can protect you against the catastrophic losses that can occur if you are sued.

Although ULI is purchased as a separate policy, your insurer will require that you have basic liability coverage (i.e., homeowners/renters insurance, auto insurance, or both) before you can purchase an umbrella liability policy. ULI is often referred to as excess coverage. Suppose you are found to be legally responsible for injuring someone or damaging someone’s property. In that case, the umbrella policy will either pay for the part of the claim over the limits of your basic liability policy or pay for certain losses that are not covered.

How important is this?

These days, it’s not unusual to hear of $2 million, $10 million, and even $20 million court judgments against individuals. If someone is injured in your home, or if you cause a severe auto accident, you could have to pay such a judgment. If you don’t have an umbrella liability policy at the time of the accident, anything above the limits of your homeowners/renters or auto insurance policy will have to come out of your pocket.

Here’s an example of how ULI works to protect you. Say you have an auto insurance policy with a liability limit of $100,000 per accident. You also have a $1 million umbrella liability policy. You’re later found responsible for a serious automobile accident, and the court finds you liable for $700,000 in damages. In this case, your auto insurance would pay the first $100,000 of the judgment, which would satisfy the deductible under your umbrella policy. Your umbrella policy would then cover the portion of the judgment not covered by your auto insurance ($600,000).

You should also be aware that certain types of liability claims (e.g., libel and slander) are not covered under basic homeowners, auto, or other types of insurance policies. An endorsement can be added to these policies to provide some protection against these types of personal injury claims. Or, you can purchase ULI, which does cover these claims.

What’s covered?

A typical umbrella liability policy provides the following protection, up to the coverage limits specified in the policy:

- Protection for claims of bodily injuries or property damage caused by you, members of your household, or hazards on your property, for which you are found legally liable

- Personal liability coverage for incidents that occur on or off your property

- Additional protection above your basic auto policy for auto-related liabilities

- Protection against non-business-related personal injury claims, such as slander, libel, wrongful eviction, and false arrest

- Legal defense costs for a covered loss, including lawyers’ fees and associated court costs

What’s not covered?

Umbrella liability insurance typically provides extremely broad coverage. Furthermore, if something is not expressly excluded from coverage, it is covered. Exclusions vary from one insurer to another and from one policy to another, but the following are some items typically excluded from coverage:

- Intentional damage caused by you or a member of your family or household

- Damages arising out of business or professional pursuits

- Liability that you accept under the terms of a contract or agreement

- Liability related to the ownership, maintenance, and use of aircraft, nontraditional watercraft such as jet skis, and most recreational vehicles

- Damage to property owned, used, or maintained by you (the insured)

- Damage covered under a workers’ compensation policy

- Liability arising as a result of war or insurrection

How big of an umbrella are we talking about?

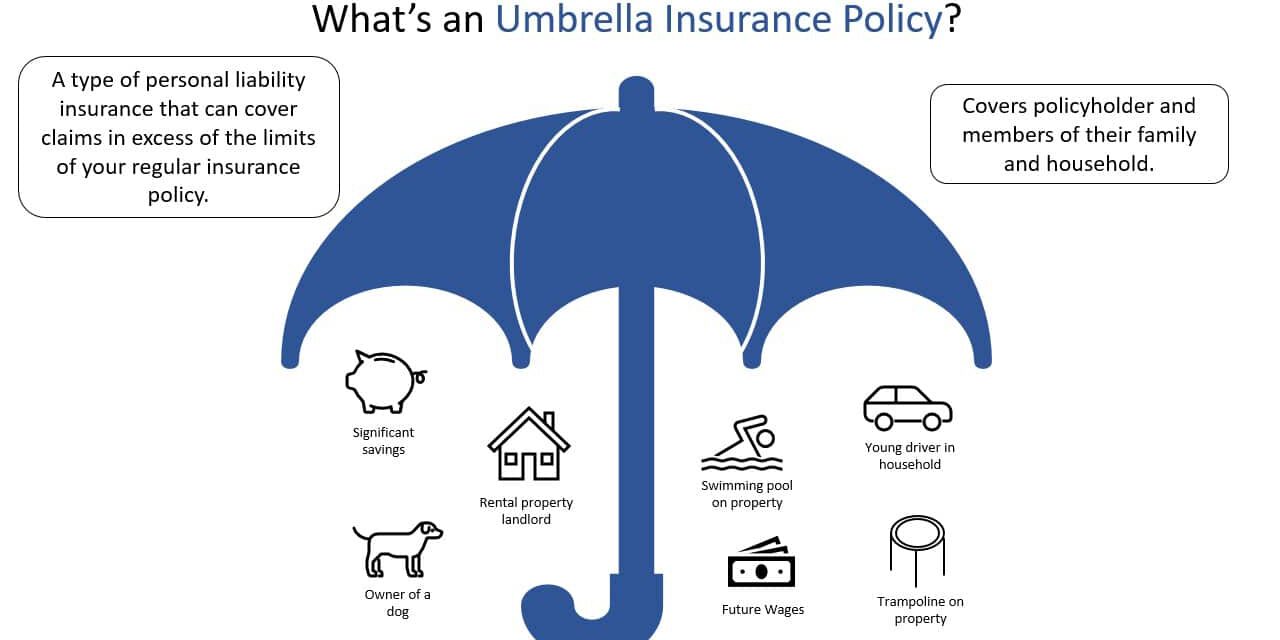

Determining how much liability coverage you need is not an exact science. You should consider factors such as how often you have guests in your home, whether you own a pool or trampoline, how much you drive, whether you have teenage drivers in your home, and whether your lifestyle gives the impression that you have “deep pockets.”

You might think that you need liability insurance only to protect your existing assets, but a large judgment against you could not only wipe out your assets but also put your future earnings in jeopardy. Any working adult who has a car or home in their name (rents or owns) should have a ULI policy, regardless of net worth.

Coverage limits vary, but a typical policy will provide liability coverage worth $1 million to $10 million. Of course, as your coverage limit increases, the premium will also increase. ULI premiums are inexpensive for the coverage offered – well worth the additional cost.

Where can I buy an umbrella liability policy?

Almost any insurer who writes auto and home insurance policies will also sell umbrella liability policies. You may also be eligible for a multipolicy discount if you purchase an umbrella policy from your current insurer.