Forecasting Failed Investors in 2023

Paul Fain, CFP®

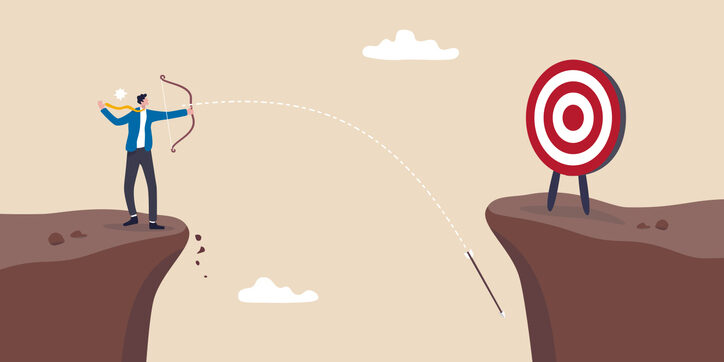

“We’ve long felt that the only value of stock forecasters is to make fortune tellers look good,” said the world’s most famous long-term investor, Warren Buffett.

To his point, last year, the forecasters from banks, brokerage firms, mutual fund companies, and the government missed their market predictions with particular ease. I hope you did not base any of your investment strategies on the opinions of these “experts.”

More importantly, such an amazing miss just reinforces the prudence of an evidence-based, long-term perspective on investment strategy.

Why are we drawn to financial forecasting like moths to flame? We yearn to believe that someone knows what will happen next to the stock market, or bond market, or the economy, or inflation, or home prices. Sometimes we suffer fear of missing out on predicted gains; other times we suffer fear of making a foreseen mistake.

Just how badly did the pundits perform in 2023?

The average stock market forecast called for a decline in the U.S. stock market. Fortunately, the representative Standard & Poor’s 500 index gained 24% last year.

Several big Wall Street firms called for Chinese stocks to substantially outperform U.S. stocks in 2023. Unfortunately, the MSCI China Index lost 11.2%.

Some pundits picked the healthcare sector to be the top-performing sector in 2023. Health stocks finished the year up 0.3%. Another analyst forecasted Apple’s share price to fall below $100. As of Dec. 31, 2023, Apple’s market price was $193. A real estate forecaster projected U.S. home prices to fall as much as 20%. In fact, the median home price went up 2%.

One well-known economist predicted a 100% chance of a recession happening in 2023. She was 100% wrong; there was no recession. Gross domestic product growth for the year is expected to be in a healthy 2-4% range.

Why were so many forecasts based on doom and gloom? War in Europe; the Fed was still raising interest rates; Americans were spending down their pandemic savings; the housing market was in decline; leading economic indicators had fallen for nine months in a row; and banks were tightening their lending standards.

What caused last year’s forecasts to miss the mark? In part, enthusiasm for artificial intelligence propelled technology stocks; inflation continued falling; consumers kept spending; and the unemployment rate fell to 3.4%, its lowest level since 1969.

“The economy and the market took those red flags and started a parade,” read one online newsletter. Once again, consumers, investors, companies, and economies proved to be resilient in the face of challenges.

What to do now? Diversify – normally markets do not go down together (2022) or up together (2023). Allocate your investments between conservative and long-term growth assets. Review your portfolio regularly and periodically rebalance your asset allocation. Keep some powder dry (risk-free cash) for spending needs. Be patient and stick to your plan.

This article originally appeared in the Knoxville News Sentinel online on January 26, 2024.