- Always spend less than you earn.

- Begin saving early for retirement.

- Build and maintain a three-month emergency fund.

- Ask, “Is this a want or a need?” before making a purchase.

- When you speak with family and friends, without judgement, listen and learn from the mistakes they made.

My husband and I were fortunate to be the first in our families to attend college and graduate with bachelor’s degrees. Back then, we thought achieving this accomplishment would help secure our financial future. We developed a plan. We created a budget. What have we learned? Plans change. We tell our children to be ready for those changes and adjust your plans accordingly.

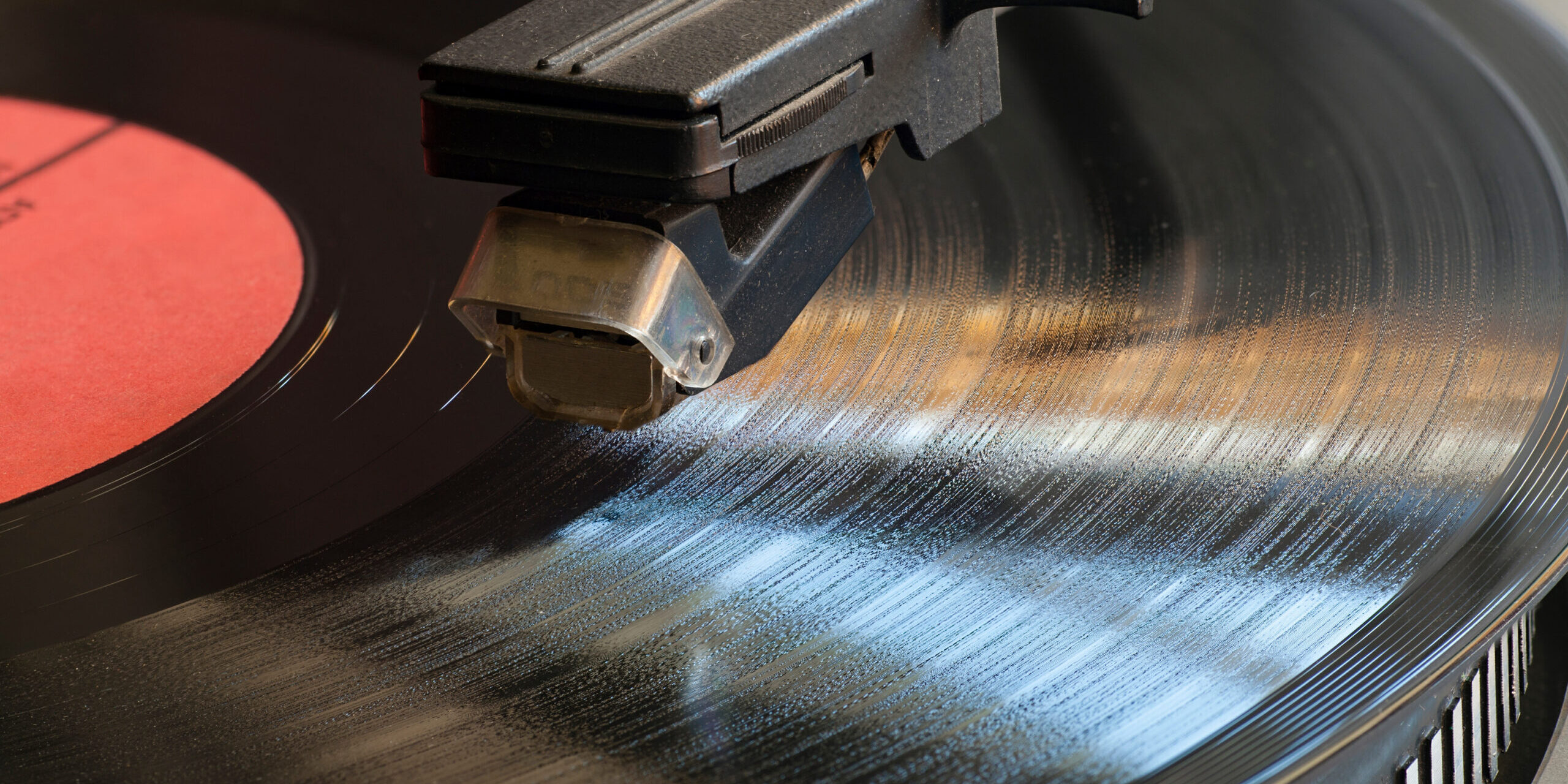

We have and will sound like a broken record reiterating at different stages in their lives these five principles. We hope sounding like a broken record becomes a genetic trait.

QUESTIONS?

Do you have questions about financial planning or investing? Send your questions to our Knoxville certified financial planners!