Doing Good GIVES You a Tax Break is a three-part series.

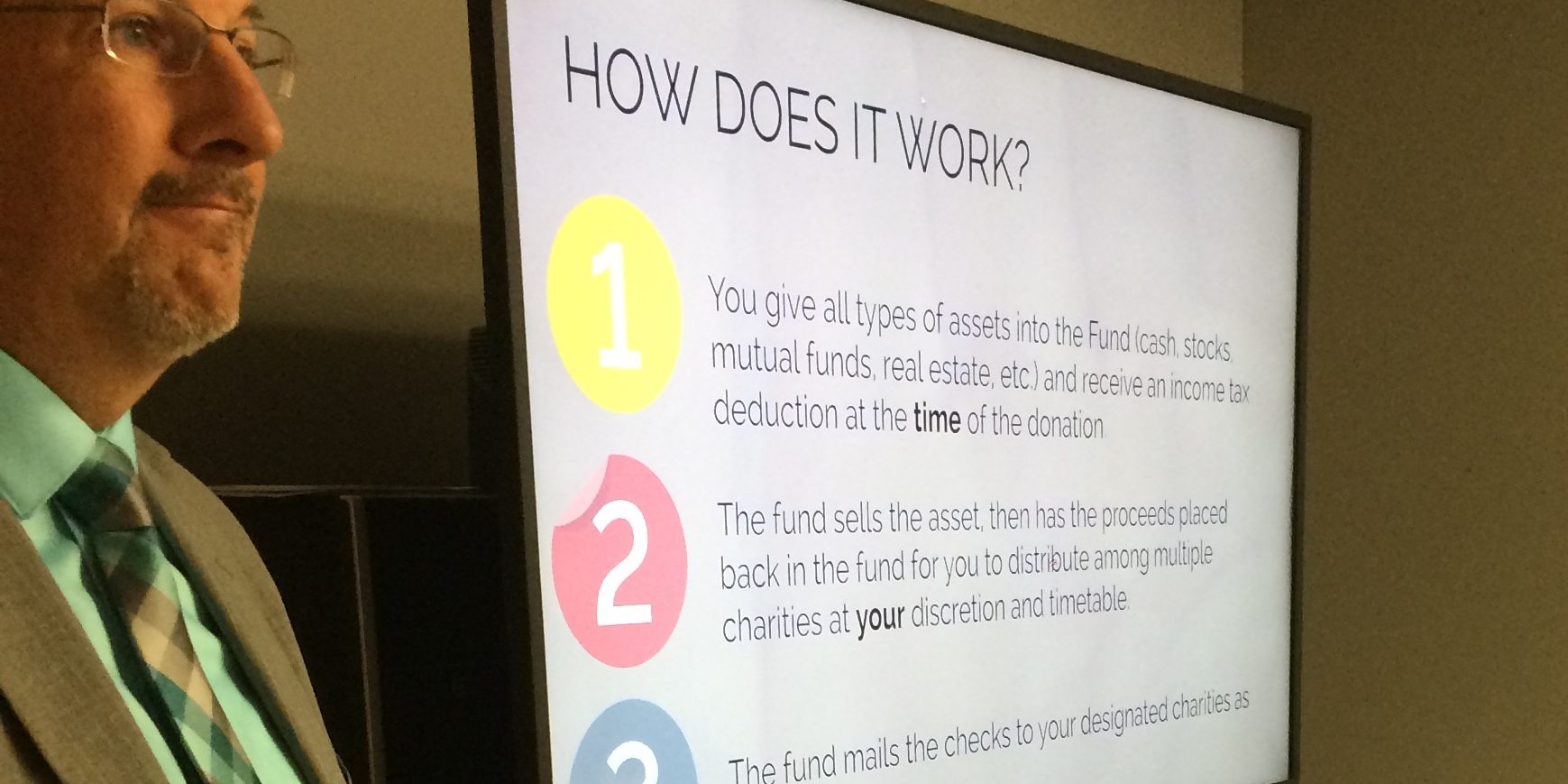

Learn how being charitable can improve your tax situation in retirement! Watch Part 3 on Donor Advised Funds below.

If you haven’t already, watch part 1 on Qualified Charitable Distributions here. To learn about a unique strategy for reducing the tax bill watch part 2 of the webinar series here. You can also check out our recent blog about Required Minimum Distributions (RMDs) for background information.

We received incredibly positive feedback from our recent event so we decided to make the presentation available to those who couldn’t make it. We hope you have enjoyed our webinar series! If you have any questions or comments please reach out to us by email: taylor@assetplanningcorp.com or phone: (865)690-1231. Because of the good feedback, we hope to provide more webinars in the future! Feel free to send us topics you would like to learn more about. We would love to help you on your financial journey.

Here are the links to the organizations who provide Donor Advised Funds in our presentation:

National Christian Foundation

https://www.ncfgiving.com/

Schwab Charitable

https://www.schwabcharitable.org/public/charitable/home

Asset Planning Corporation (“Advisor”) is a registered investment advisor. The information contained in this report is for informational purposes only and should not be considered investment advice or recommendations. Advice may only be provided after entering into an advisory agreement with Advisor.