You can find good news, if you look for it.

On the other hand, bad news is easy to find: war, inflation, the COVID-19 pandemic. Bad news is typically unexpected. Financially, bad news is often cyclical. Periods of economic growth are followed by recession. Stock market booms are followed by busts.

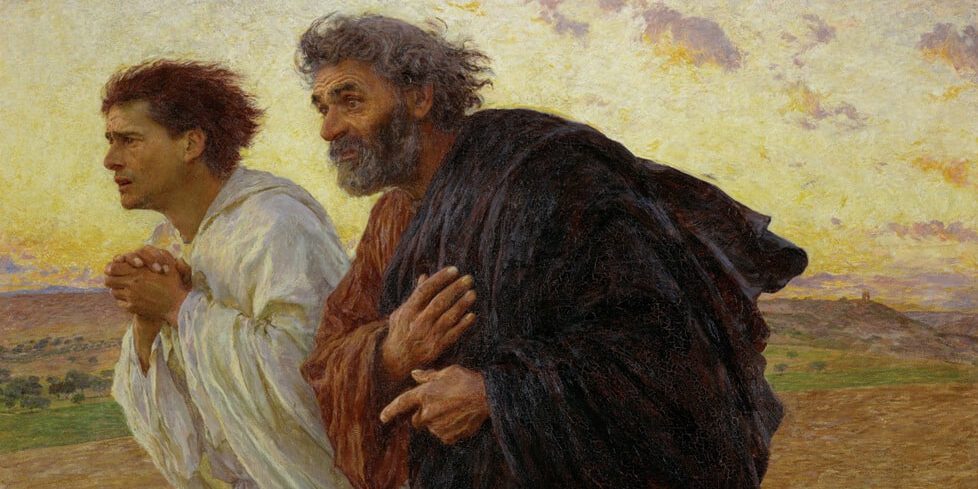

Sometimes bad news is not life-altering, just disappointing. Several years ago, we took our family to the Louvre Museum in Paris, France. My wife made a beeline to see Eugene Burnand’s 1898 painting of the disciples Peter and John running to the tomb of Jesus. Alas, bad news, it was removed for maintenance.

With that context, let’s look for some good news.

Inflation has declined to 4%. Last year the cost of living spiked to 8.5%, its highest rate since 1982. As of last week, the national average for a gallon of gas was $3.58, down from $5 one year ago, according to AAA. Based on spring statistics, national housing prices were down 2% compared to last year. Maybe overheated markets are finally cooling down after years of price inflation. Food costs remain high, but some declines are worth mentioning: eggs, milk, citrus fruits, and uncooked beef and poultry are more affordable.

A survey found that 86% of workers who are actively engaged with their finances are more likely to feel good about their situation. During the pandemic, downloads of personal finance apps grew by roughly 90%. People like having the power to run their financial world in the palm of their hand.

Defying predictions of a short military conflict, Ukrainians are hanging strong in their battle with Russia.

As long as “SkyNet” (the fictional artificial intelligence in the Terminator movies) is never given the launch codes, AI is probably a net positive.

Despite forecasts for a market crash, the S&P 500 index of U.S. stocks is up over 14% year to date. With recession doomsayers circling the economy, gross domestic product leaned forward with 1.3% growth last quarter. Corporate profits increased 5%, reversing the previous quarter (down 2%). Supply chains are being recalibrated to be resilient, not just efficient. The unemployment rate has declined to 3.5% from a pandemic peak of 14%.

Money market funds are yielding north of 4.5% versus 0.5% one year ago. The Federal Reserve hit pause and did not raise interest rates this last go-round. Thus, borrowing rates may level off for a while.

COVID-19 daily deaths peaked at 4,200 in 2021. Recently, that number was 255.

A study found that older men put on a simple eight-week program were able to reduce their biological age by 3.2 years. The changes consisted of recommendations for better sleep, some supplements including phytonutrient powder and a probiotic, a daily 10-minute meditation or breathing practice, a 12-hour eating window, and 30 minutes of exercise per day five days a week. Health is wealth.

The bottom line: Human beings are resilient. We cannot do enough to try to counteract the human tendency to give more weight to the negative in the face of the fundamental fact of human resilience.

This article originally appeared in the Knoxville News Sentinel online on June 23, 2023.