Legacy Planning: Designating Your Beneficiaries

by Suzanne Hornick | Feb 9, 2021

According to the Investment Company Institute, total US retirement assets exceed $23 trillion, mostly in employer-sponsored retirement plans and IRAs. How these assets transfer to the next generation is a very important part of the financial planning process. Typically, these assets will pass to the next generation based solely on the client’s beneficiary designation form. This means the beneficiary designation form is one of the most important estate planning documents to fill out accurately and to review often.

A beneficiary designation form usually allows for both a primary beneficiary and a contingent beneficiary. Beneficiaries can be any living person or entity. Primary beneficiaries are the individual(s), trust(s), charities, etc. you designate to receive your assets upon your death. Contingent beneficiaries will receive your assets only if there are no surviving primary beneficiaries at the time of your death. It is a good idea to name contingent beneficiaries especially if your primary beneficiaries are natural persons.

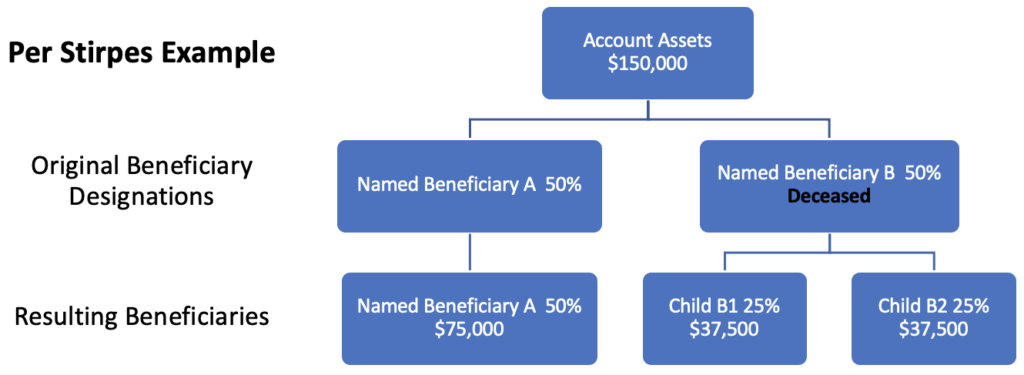

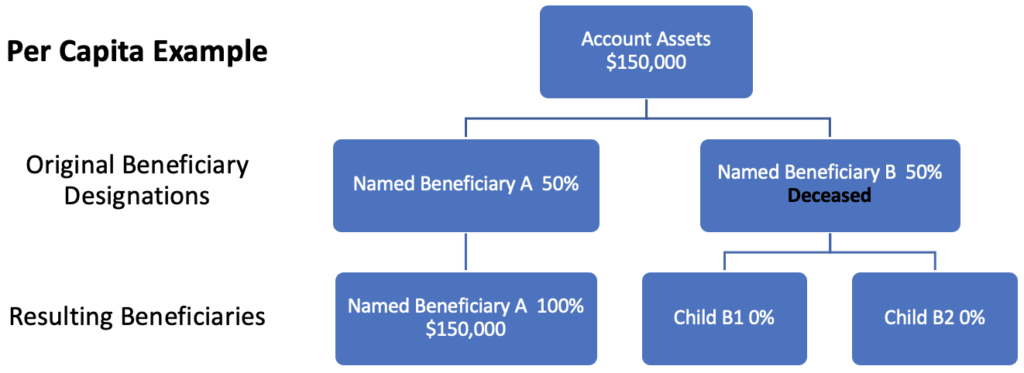

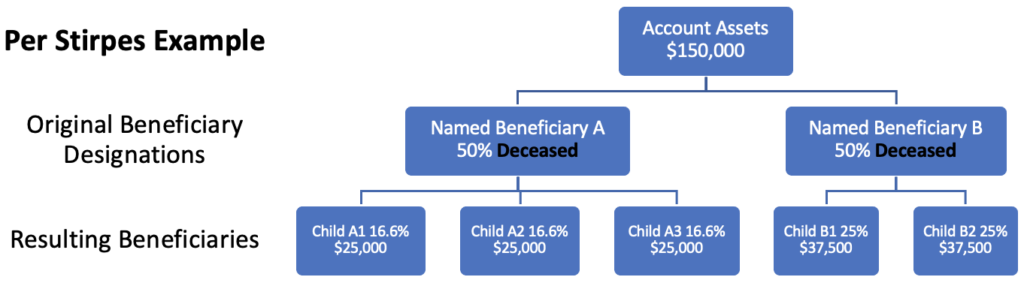

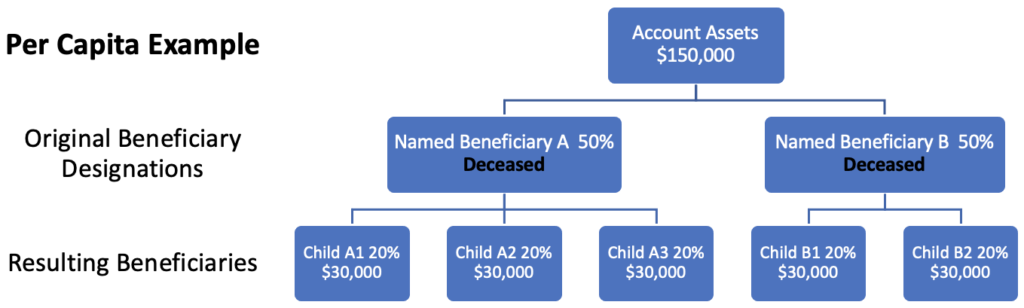

Beneficiaries may be set up as Per Capita or Per Stirpes. The difference between Per Stirpes and Per Capita is in how your assets would be distributed if any of your primary beneficiaries die before you. Per Stirpes and Per Capita distributions are limited to your named beneficiary’s children and no further descendants.

Here are some examples to illustrate potential results based on a Per Capita or Per Stirpes designation.

When Some Primary Beneficiaries Are Deceased:

When All Primary Beneficiaries Are Deceased:

Life Event Checklist:

If you experience any of the following events, it’s a good time to review your beneficiaries:

o Marriage

o Divorce

o Birth or adoption of a child

o Birth or adoption of a grandchild

o Child attaining adulthood

o Marriage or divorce of an adult child

o New job

o Change in employer retirement plan or insurance providers

o Retirement Plan Rollover

o New insurance policy

o Illness or incapacity of a beneficiary

o Death of a beneficiary

o Inheritance

o Establishment of a Trust

Is it time to review your beneficiaries?

By making sure your beneficiary information is accurate and current you’ll leave behind not just your assets, but the knowledge that you cared enough for your loved ones to make the asset transfer easy for them. Life events can mean your beneficiary forms need updating. As always, we recommend that you coordinate any changes with the rest of your estate plan and consult with an estate attorney.

QUESTIONS?

Do you have questions about financial planning? Send your questions to our Knoxville certified financial planners or directly to Suzanne@assetplanningcorp.com!